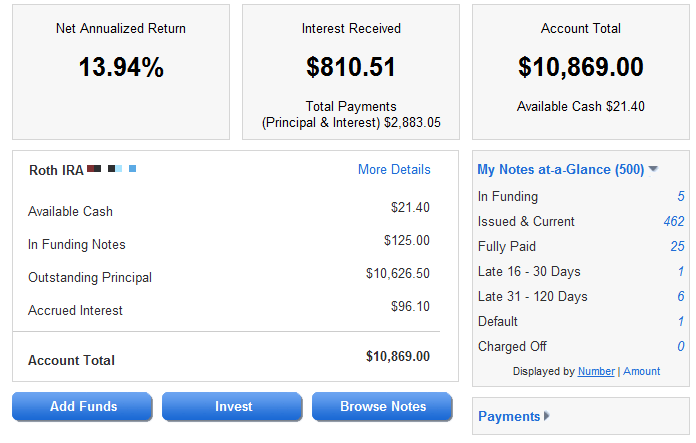

It’s been about ten months since I started my Lending Club IRA account.

All in all it’s been going pretty well. I’m a little surprised at how few late or defaulted notes there are at this point. I may be jaded by my Prosper experiences, but I expected more people to get their money and not make any payments. On the other hand, the number of Fully Paid notes at this point is higher than I would’ve predicted. Perhaps these were solid borrowers who needed short term loans but were turned away by the banks? I haven’t gone back through and looked at the individual notes.

The plan is to continue rolling principal and interest payments into new notes indefinitely. Assuming that my non-LC retirement accounts continue to perform acceptably, I don’t foresee being overweight on Lending Club. Each year I’ll evaluate the balances on all my retirement funds and decide whether my yearly Roth IRA contribution should go towards Lending Club or other places. While I want to maximize my total return, I’m conscious of not wanting to be overweight on Lending Club overall.